Property Tax Depreciation - Rental Property Depreciation Schedules

`Four out of five property investors do not realise they need to provide their accountant with a tax depreciation schedule for each investment or rental property. Without one, you are missing out on thousands of dollars of tax deductions each year.' Liam Hannah - BAppSc (Quantity Surveyor) Managing Director

Below is an explanation of the fundamentals of property tax depreciation, and how it can be applied to your particular situation. On average, engaging ADM to prepare your properties depreciation schedules can save you between $5,000 - $10,000 in the first full year of property ownership.

It is important if you have any questions that can not be answered on the website, that you contact us to clarify. We are here to assist and guide you through the process

What is Property Tax Depreciation ?

Property Tax Depreciation is a piece of Australian Tax Office Legislation that was introduced in 1985 to stimulate the construction industry & provide much needed rental accommodation for Australia's increasing population. The workings of this legislation provided large tax deductions for people who invested in property for the rental market, as for the holding costs of the property asset is reduced significantly when a tax depreciation schedule is applied to the property.

Claiming depreciation on your investment rental property is a perfectly legal way to reduce the tax burden of your income producing investment property in it's current year, and simply defer that tax to a later date. It allows owners of an investment or rental property to keep positive cash flow by taking an expense for the normal wear and tear on a property.

Property Tax Depreciation reduces an investors current years income on the property. The depreciation which has been claimed is then added back to the cost basis of the property when it is sold. Claiming for the depreciation will maximise the property's monthly cash flows and aid in quicker loan pay off. It makes sense to capture as much property depreciation as possible.

How much Property Tax Depreciation ($) Deductions can I claim?

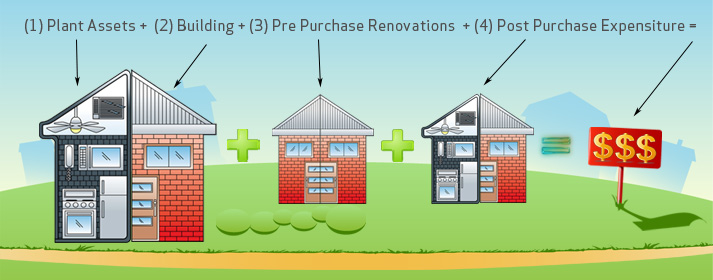

The amount that you can save depends on 4 factors

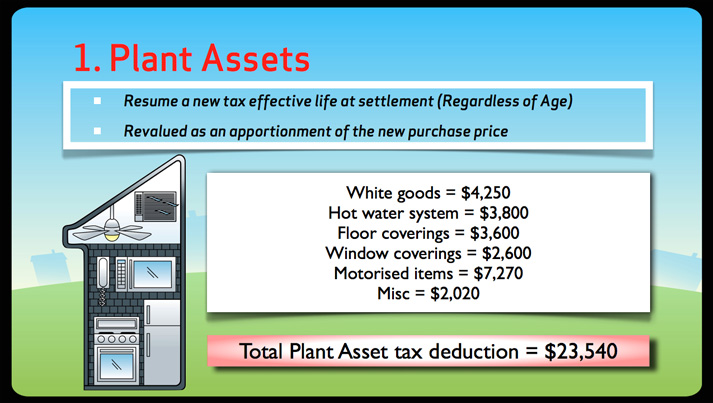

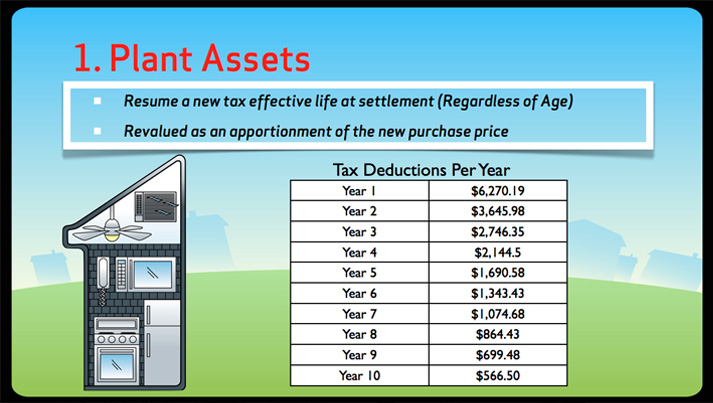

1. (Plant Assets) The value of the plant asset items bought with the property at settlement

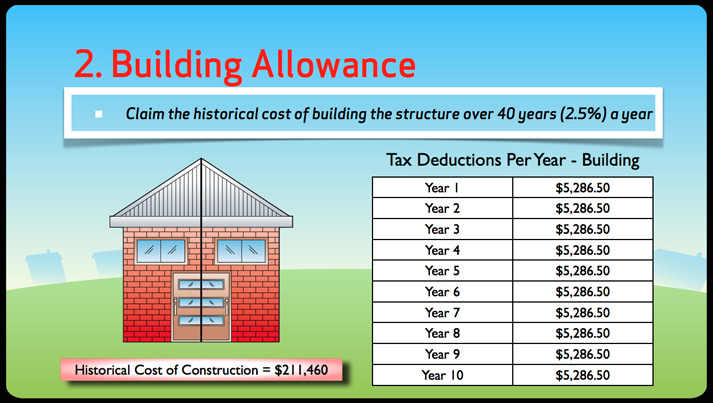

2. (Building Allowance) The historical cost to build the original structural element of the property - (This applies to properties built after 1988)

3. (Pre Purchase Renovations or Extensions) The historical cost of any improvements to the original structure of the property - (By the previous owner)

4. (Post Purchase Expenditure) The cost of any expenditure by the owner after settlement

It's very important to note that you can claim substantial tax deductions on - New, old, renovated, shared, and even properties that you have owned for many years and not claimed any depreciation.

Property Tax Depreciation Terminology

* Deprecation - Assets lose their value over time as a result of wear and tear, age, or obsolescence. (In other words they depreciate)

* Effective Life - The timeframe (years) in which you can claim the assets value over

1. Plant Assets - Depreciation

Plant assets, are items which to do form an integral part of the building structure. Examples of these items include for kitchen white goods, the hot water system, floor coverings such as (carpet, vinyl or floating timber), Blinds or curtain window coverings, smoke detectors, loose furniture, and any items which has a small electronic motor like, (ceilings and exhaust fans, air conditioners, solar paneling systems, pumps and motorized gates and garage doors.

Important Information

It is very important to note that the plant assets bought with the property at settlement, are revalued as a proportionment of the new purchase price and resume a new tax effective life. That means that even if the asset is 25 years old, it is revalued at each propery purchase and can be depreciated over its effective life.

2. Building Allowance - Depreciation

The second factor that determines how much depreciation you can claim is the original cost to build the structural element of the building. The tax office states that you can claim this cost equally over a 40 year period. It is important to note that properties built before 1988 will not receive any (Building Allowance) but this should not deter you from applying depreciation to your property. There will still be thousands of dollards available by claiming for your (Plant Assets) and also considering deductions any previous renovations or extentions that occured before and after the property settlement.

1. Property Built 2011 (3 Bed, 2 Bath + Garage) The Total Building Allowance = $211,460

* $211,460 x 2.5% (40 years) = $5,286.50 each year for 40 years

2. Property Built 2000 (3 Bed, 2 Bath + Garage) The Total Building Allowance = $110,000

* $110,000 x 2.5% (40 years) = $2,750 each year for 40 years

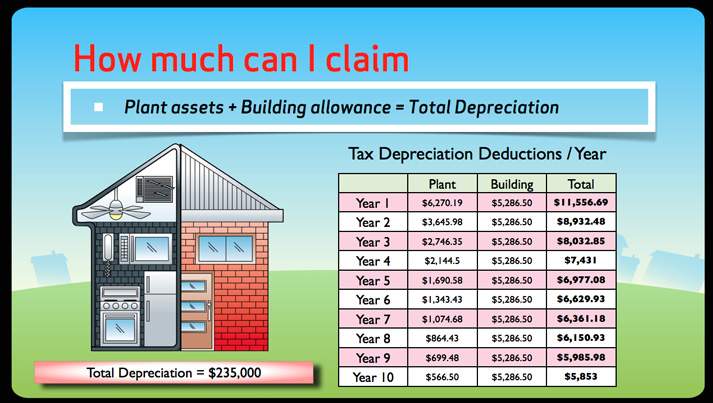

Simple Depreciation Example - Total Depreciation

3. Pre Purchase Renovations or Extentions - Property Depreciation

The third factor relates only if you have bought an existing or older property and it has had improvements to the original building structure. An example would be if the property had a pergola built onto it. Now you can claim for the historical cost of the pergola equally over a 40 year period.

4. Post Purchase Expenditure - Property Depreciation

And finally you can claim tax deductions for any costs that you incur after the property purchase. These expenses could fall into one of three categories and is important to note that they are claimed from the date of installation at the amount you paid for the item plus any installation costs. Installing an air-conditioning unit is claimed as a plant assets over its specific effective life. Adding structural elements like a new vanity basin or kitchen joinery is claimed equally over 40 years. Repairing a broken hot water unit is classed as repairs and maintenance and can be claimed at 100%.

The values that are associated with the first 3 factors are estimated and analyzed by an appropriately qualified person then reported in a document which is called a tax depreciation schedule.

Tax Depreciation Summary

As you can clearly see now that all investment properties are eligible to claim for thousands of dollars worth of depreciation deductions.

How do I order a Tax Depreciation Schedule

For a once off fee you can order online from ADM. (Fee 100% tax deductible)Click here to order

- A thorough inspection of your investment property by a registered tax agent and quantity surveyor to identify all plant assets (fixtures / fittings) and building capital works deductions.

- A full tax depreciation schedule for the lifetime of the property, which outlines all legitimate deductions, plus any additional post purchase expenditure.

It’s easy, quick and affordable.

We guarantee that you will claim the maximum legitimate deductions allowable under the Tax Act, giving you more cash to grow your portfolio. Australian Depreciation Manangement provide taxation advise to thousands of property investors Australia wide. Registered tax agents and quantity surveyors, specializing in rental property depreciation schedules.

Remember not claiming your depreciation is similiar to not charging your tenant rent

to receive a quote or order a depreciation schedule

Specialists in property tax depreciation